For rental property owners looking to build long-term wealth while minimizing their tax exposure, a 1031 exchange is one of the most powerful tools available in real estate. It’s not just about tax deferral—it’s about repositioning your portfolio, optimizing your returns, and scaling toward your investment goals with strategy and clarity.

In this blog, we’ll explore what a 1031 exchange is, how it works, and how top real estate investors use it to build generational wealth—drawing on expert insights from a previous webinar hosted by KeyOpp Real Estate featuring 1031 specialists James Callejas and Ross Fong from IPX 1031.

Why Investors Choose Real Estate

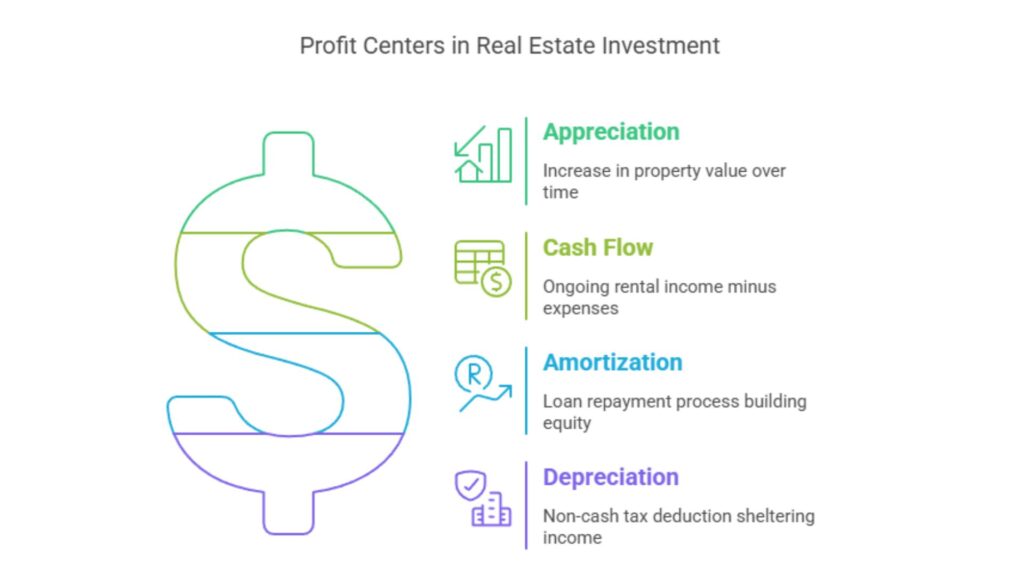

Many investors compare real estate to traditional stock investments, particularly index funds like the S&P 500, which have historically yielded around 10% annually. While that may sound superior to the average 6% appreciation of real estate, this comparison overlooks the multi-dimensional nature of real estate returns.

When combined with leverage (other people’s money, or OPM), these profit centers can significantly outperform traditional investments over time.

“Most people think they’re sitting on a cash cow, but the return on investment is actually under 1%.”

— James Callejas

This is especially true for Bay Area owners whose properties have appreciated but offer little to no cash flow due to rent control or high maintenance costs.

The Lifecycle of a Real Estate Investment

Every property goes through a natural lifecycle: acquisition, holding, and eventually, disposition. During the holding phase, investors benefit from the four profit centers. But what happens when returns decline? That’s often a sign it may be time to sell.

For example, a property that’s fully amortized, fully depreciated, and experiencing declining cash flow may no longer be serving its owner well. However, selling such a property usually results in significant capital gains taxes—unless the sale is structured as a 1031 exchange.

“You don’t do a 1031 exchange just to avoid taxes. You do it because the current investment no longer makes sense.”

— James Callejas

What Is a 1031 Exchange?

Named after Section 1031 of the Internal Revenue Code, a 1031 exchange allows investors to defer capital gains taxes by reinvesting the proceeds from a sale into another investment property. The key requirement is that both properties must be held for business or investment purposes, though the type of property can vary significantly.

Contrary to popular belief, you don’t have to exchange “like for like” in terms of use or structure.

“You don’t have to buy the same kind of property. Just buy something held for investment use.”

— James Callejas

For example, you could sell a duplex in San Francisco and buy several single-family rentals in Nevada.

The exchange also resets your depreciation schedule, offering fresh tax advantages—a crucial benefit if your current property is fully depreciated.

Tax Deferral: The Hidden Power Behind 1031 Exchanges

One of the biggest barriers to selling appreciated real estate is the tax hit. Between federal capital gains tax (25-20%), state tax (13.3% in California), depreciation recapture which is taxed as ordinary income, and the Net Investment Income Tax, total liabilities can exceed 30-40%.

A properly executed 1031 exchange defers all these taxes, preserving capital that can be reinvested into higher-performing assets.

“You can make millions on an asset, sell it, and defer paying any capital gains tax.”

— James Callejas

This deferral benefit is why many seasoned investors use a “swap ‘til you drop” strategy, exchanging properties throughout their lifetime and leaving heirs with a stepped-up basis upon death—effectively eliminating the accumulated deferred taxes altogether.

Timing Is Everything: Understand the Deadlines

Successfully executing a 1031 exchange requires meeting two critical deadlines:

- 45 days to identify replacement properties (in writing).

- 180 days to complete the purchase of the property.

This limited window can be a major challenge, particularly in low-inventory markets.

“The 45-day identification period is the hardest part—and the most important to plan ahead for.”

— James Callejas

Working with an experienced team before listing your property is essential to avoid scrambling to find replacement options under pressure.

How to Identify Properties: The Three IRS Rules\

“You can’t just hand us the entire MLS and say you’ve identified. The IRS wants it specific, and you’re bound by what you identify.”

— James Callejas

Understanding these rules helps ensure compliance and preserves your ability to defer taxes. It’s essential to strategize your identification approach early with your real estate advisor and intermediary.

Advanced 1031 Exchange Strategies

While traditional 1031 exchanges involve selling a property before buying a replacement, certain market conditions and investment goals may require more flexible approaches. Two commonly used advanced strategies are:

Reverse Exchange

In a reverse exchange, the investor purchases the replacement property first and then sells the relinquished property.

Since you haven’t sold your original property yet, a special-purpose entity (usually set up by your Qualified Intermediary) temporarily holds title to the replacement property until the original property is sold.

- Key Benefits: Avoid losing out on a desirable property to another buyer.

- Caveats: Requires liquidity or bridge financing.

“We’ve never seen more reverse exchanges than we have in the last few years. The hardest part of a 1031 is identifying in 45 days. If you can buy first, it removes that pressure.”

— James Callejas

Improvement Exchange

An improvement exchange allows you to use exchange proceeds to make improvements to the replacement property within the 180-day exchange window.

This is useful when:

- The replacement property is under market value.

- You want to add an ADU or perform renovations to meet valuation.

Improvements must be completed before the 180th day, and the qualified intermediary or their entity must be on title during construction.

- Key Benefits: Maximize tax deferral while customizing your investment.

- Caveats: Requires tight coordination with contractors and your QI.

“If you’re going to use an improvement exchange, plan early. You’ll need your contractors, plans, and permits lined up, because the IRS doesn’t give extensions. 180 days means 180 days.”

— James Callejas

The Role of the Qualified Intermediary (QI)

A 1031 exchange cannot be completed without a Qualified Intermediary (QI), who facilitates the transaction and holds the sale proceeds. However, this is a largely unregulated industry, so choosing the right QI is vital.

“Not all Qualified Intermediaries are created equal—ask for proof of insurance, bonding, and knowing who holds your money.”

— James Callejas

IPX 1031, for example, is backed by Fidelity National Financial and offers over $100 million in bonding and insurance to safeguard client funds.

Real-World Example: Unlocking Equity in Noe Valley

Consider a long-time owner of a three-unit property in Noe Valley, originally purchased for $50,000 in the 1970s. It’s now worth $3 million but fully amortized and depreciated, with rent-controlled tenants and mounting maintenance.

Instead of selling outright and losing $1M+ to taxes, the owner executes a 1031 exchange, reinvesting in:

- A modern apartment building with market-rate rents

- A triple-net retail property requiring no active management

- Several out-of-state rentals offering higher cash flow

The result? Reduced management burden, refreshed tax shelter, and improved returns—all while deferring taxes.

A Strategy for Long-Term Wealth

A 1031 exchange is more than a tax deferral tool. It’s a strategic mechanism for repositioning your real estate portfolio, unlocking trapped equity, and scaling your investments.

“1031 exchanges are the greatest wealth-building tool in real estate. Nothing else allows you to keep more of your money working for you.”

— James Callejas

If you’re a rental owner with a long-held asset that no longer meets your goals, a 1031 exchange could be your next step toward greater returns and lasting wealth.

Considering a 1031 Exchange?

At KeyOpp Real Estate & Property Management, we help rental owners across the San Francisco Bay Area evaluate whether a 1031 exchange is right for them and if it is we will refer them to trusted experts like IPX 1031. If you’re considering repositioning your real estate assets, contact us for a personalized strategy session.

Ready to learn more 1031 exchanges?

Reach out to our team today!

Kelvin Kam, the Broker of Record for KeyOpp Real Estate and Founder of Sequoia Real Estate, stands out as a pragmatic leader in the real estate domain. Since embarking on his journey in 2003, Kam’s trajectory embodies a strategic fusion of foresight, diversification, and an unwavering commitment to excellence.

Kelvin Kam, the Broker of Record for KeyOpp Real Estate and Founder of Sequoia Real Estate, stands out as a pragmatic leader in the real estate domain. Since embarking on his journey in 2003, Kam’s trajectory embodies a strategic fusion of foresight, diversification, and an unwavering commitment to excellence. Karmen Wong’s journey to real estate was inspired by her positive experience buying a home with her sister over two years ago. Their agent, who was patient and knowledgeable, made the transaction feel like a breeze. This experience, coupled with her Aunt’s belief in real estate investment, ignited Karmen’s interest in pursuing it as a career. She is driven by the opportunity to help others through one of the most significant transactions in their lifetime.

Karmen Wong’s journey to real estate was inspired by her positive experience buying a home with her sister over two years ago. Their agent, who was patient and knowledgeable, made the transaction feel like a breeze. This experience, coupled with her Aunt’s belief in real estate investment, ignited Karmen’s interest in pursuing it as a career. She is driven by the opportunity to help others through one of the most significant transactions in their lifetime. Eileen Chau’s journey to real estate was inspired by her childhood experiences in a family business and frequent relocations, fostering an intrigue for architecture, interior design, and negotiation styles unique to different cities. This diverse background naturally led her to become a real estate agent, where she could seamlessly merge her passions.

Eileen Chau’s journey to real estate was inspired by her childhood experiences in a family business and frequent relocations, fostering an intrigue for architecture, interior design, and negotiation styles unique to different cities. This diverse background naturally led her to become a real estate agent, where she could seamlessly merge her passions. Letty, a proud native of San Francisco, brings a wealth of diverse experiences in her role as a Realtor. Having lived in neighborhoods such as Crocker Amazon, Ingleside, and Sunset and attended schools in Chinatown, Mission, Balboa Terrace, Parkside and Park Merced, she offers direct knowledge and experiences of the vast communities in San Francisco.

Letty, a proud native of San Francisco, brings a wealth of diverse experiences in her role as a Realtor. Having lived in neighborhoods such as Crocker Amazon, Ingleside, and Sunset and attended schools in Chinatown, Mission, Balboa Terrace, Parkside and Park Merced, she offers direct knowledge and experiences of the vast communities in San Francisco.

Katrina embarked on her professional journey as a Digital Marketing Specialist in Real Estate right after graduating in 2019 with a Bachelor of Arts in Business Administration, majoring in Marketing Management. Her role sparked a passion for creativity and learning in real estate advertising, aligning perfectly with her business-minded nature and aspirations to own a business one day. With five years of experience under her belt, Katrina is particularly drawn to the ever-evolving nature of marketing, which challenges her to continuously learn and adapt to new technologies.

Katrina embarked on her professional journey as a Digital Marketing Specialist in Real Estate right after graduating in 2019 with a Bachelor of Arts in Business Administration, majoring in Marketing Management. Her role sparked a passion for creativity and learning in real estate advertising, aligning perfectly with her business-minded nature and aspirations to own a business one day. With five years of experience under her belt, Katrina is particularly drawn to the ever-evolving nature of marketing, which challenges her to continuously learn and adapt to new technologies. I began my Real Estate career in 2020 as a Compliance Transaction Coordinator. I was their very first virtual assistant. As a pioneer, I finally became team leader.

I began my Real Estate career in 2020 as a Compliance Transaction Coordinator. I was their very first virtual assistant. As a pioneer, I finally became team leader. I’m a Realtor, Investor, Developer, and a Mother of two children. I’ve project-managed over $40 million in residential developments in San Francisco and the Bay Area. I am originally from Vancouver, Canada and moved in 2000 to the Bay Area where I began in Commercial Banking and then Title & Escrow Sales. Furthering my passion in Real Estate, I purchased my first out-of-state investment property in 2003, and first home in 2005, I’ve learned the meaning of cash flow, and since then have rehabbed and lived in multiple duplexes and single family homes in San Francisco. I love the multi-facets of Real Estate investing, and sharing this knowledge with friends so that we can all grow together and reach financial freedom.

I’m a Realtor, Investor, Developer, and a Mother of two children. I’ve project-managed over $40 million in residential developments in San Francisco and the Bay Area. I am originally from Vancouver, Canada and moved in 2000 to the Bay Area where I began in Commercial Banking and then Title & Escrow Sales. Furthering my passion in Real Estate, I purchased my first out-of-state investment property in 2003, and first home in 2005, I’ve learned the meaning of cash flow, and since then have rehabbed and lived in multiple duplexes and single family homes in San Francisco. I love the multi-facets of Real Estate investing, and sharing this knowledge with friends so that we can all grow together and reach financial freedom. With over 30 years of real estate experience, Lawrence brings a family-focused approach to Real Estate. Starting early on by assisting his father with hands-on repairs and maintenance with various properties and later assisting with the backend operational processes, Lawrence along with his wife Melanie Leung have a developed multiple businesses focusing on all aspect of Real Estate including, but not limited to, Property Management, Investment Strategies as well as Buyer and Seller Representation. By working in multiple aspects of the real estate process, he brings a multi-faceted perspective to the buying and investment process. As a duo team with a strong knowledge of property investment, Lawrence is able to provide all the necessities an investor needs to make the smart choices.

With over 30 years of real estate experience, Lawrence brings a family-focused approach to Real Estate. Starting early on by assisting his father with hands-on repairs and maintenance with various properties and later assisting with the backend operational processes, Lawrence along with his wife Melanie Leung have a developed multiple businesses focusing on all aspect of Real Estate including, but not limited to, Property Management, Investment Strategies as well as Buyer and Seller Representation. By working in multiple aspects of the real estate process, he brings a multi-faceted perspective to the buying and investment process. As a duo team with a strong knowledge of property investment, Lawrence is able to provide all the necessities an investor needs to make the smart choices. Having grown up with parents working in real estate, I found my passion for this industry at an early age. I chose to follow in their footsteps after seeing how many clients they were able to help fulfill the American Dream of Home Ownership. After 7 years of working extensively in the San Francisco Bay Area, I have developed a keen understanding of the local market and always take the time to figure out what clients really need from me as a professional real estate broker. I take pride in serving my clients with the utmost level of care and professionalism. It is my job to ensure a smooth, worry-free, and satisfying experience for everyone involved.

Having grown up with parents working in real estate, I found my passion for this industry at an early age. I chose to follow in their footsteps after seeing how many clients they were able to help fulfill the American Dream of Home Ownership. After 7 years of working extensively in the San Francisco Bay Area, I have developed a keen understanding of the local market and always take the time to figure out what clients really need from me as a professional real estate broker. I take pride in serving my clients with the utmost level of care and professionalism. It is my job to ensure a smooth, worry-free, and satisfying experience for everyone involved.